Funding options for start-ups

March 20, 2019

We were lucky to have two local experts at OCFI to talk about Funding options for start-ups – Eileen Modral, Investment Manager for from OION (Oxford Investment Opportunity Network, originally set up by The Oxford Trust) and David Ford from Arrowfield Capital, an Oxford-based life sciences angel syndicate. With many years’ experience between them, they gave us the low down on the key areas of finance – grants, debt and equity.

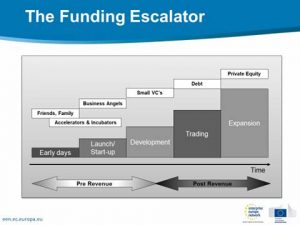

Eileen started by showing a slide on the “Funding Escalator” that illustrates where each type of funding typically kicks in: early pre-revenue days businesses tend to attract friends and family, accelerators and incubators, and, if lucky, a business angel or two. In the next development stage, start-ups often get funding from venture capital and when trading and earning revenue debt finance can be key. It is only at the expansion stage that companies will tend to attract private equity.

Eileen points out that “applying for grants is hard work so you need to make sure that it is funding a core part of your businesses.” Grants are not simply “free money” – in most cases you will need to prove the cash will be put to good use and the application process can be painful. That said, for start-ups and small businesses there are a few government-backed schemes offering grants to help build up your business. One of these is the Enterprise European Network (ENN) and has advisors worldwide to help SMEs find trusted partner to develop products and services or to move into new markets. This year there is a committed £5m to support UK businesses in the Eurostars projects, 2019. And, closer to home, there’s also OxLEP who can give a foot up to small, local businesses.

The advantage of debt financing, of course, is that you aren’t diluting your ownership and control as you might do with equity. It can also help your business reach the metrics needed to get better terms when you do raise private equity at the next stage. If your company is revenue-generating, debt is often used in the short term to bridge companies to the next round of financing. Debt funding can be accessed in a variety of ways: friends and family in the early stages, banks, venture debt and more recently peer-to-peer lending sites. These can be a good option as the terms tend to be less onerous than banks.

And then there’s equity. Early stage equity investment tends to come from angel investors. When a company is in development, this is when venture capital is useful. Companies don’t tend to attract private equity until the business is revenue generating and expanding. “Don’t forget the Entrepreneurs’ Golden Rule”, says Eileen, “the further you get on the money, the more of the company you have in the end.” She also says it is important to “remember the three principles of investment: all investors want their money back; want a return on their investment; and that return will be proportionate to the risks involved.” Eileen and David both said that it is important to research and find the right investor/s – it is not only money they can help with but expertise too. And, if you are raising finance, make sure you start that journey well in advance.

If you’re interested in funding for start-ups, this was only a taster session. There are more in-depth round table events down the line: equity on 27 March; and debt finance on 9 April. The round-table events will allow businesses to ask more questions direct to the experts. Come along! Oh, and I forgot to mention there’s coffee and croissants too!